intelligentSEGMENTS

Build an accurate story of your prospects and customers.

intelligentVIEW plans include intelligentSEGMENTS

NEW actionable segmentation system that clusters Canadians into 94 segments based on socio-economics, wealth, ethnicity, education, behaviours, expenditures, and lifestyle data.

Are your customers changing or evolving? Our versatile segmentation system gives you the advantage of precision targeting:

Quarterly updates (compared to an industry average of 12 to 18 months)

Segment your customers and build out your own personas

Activate digital and direct audiences with data from over 16 million Canadian households

Align online and offline segmentation data with confidence and rapidly measure the results

See the Top Canadian Segments

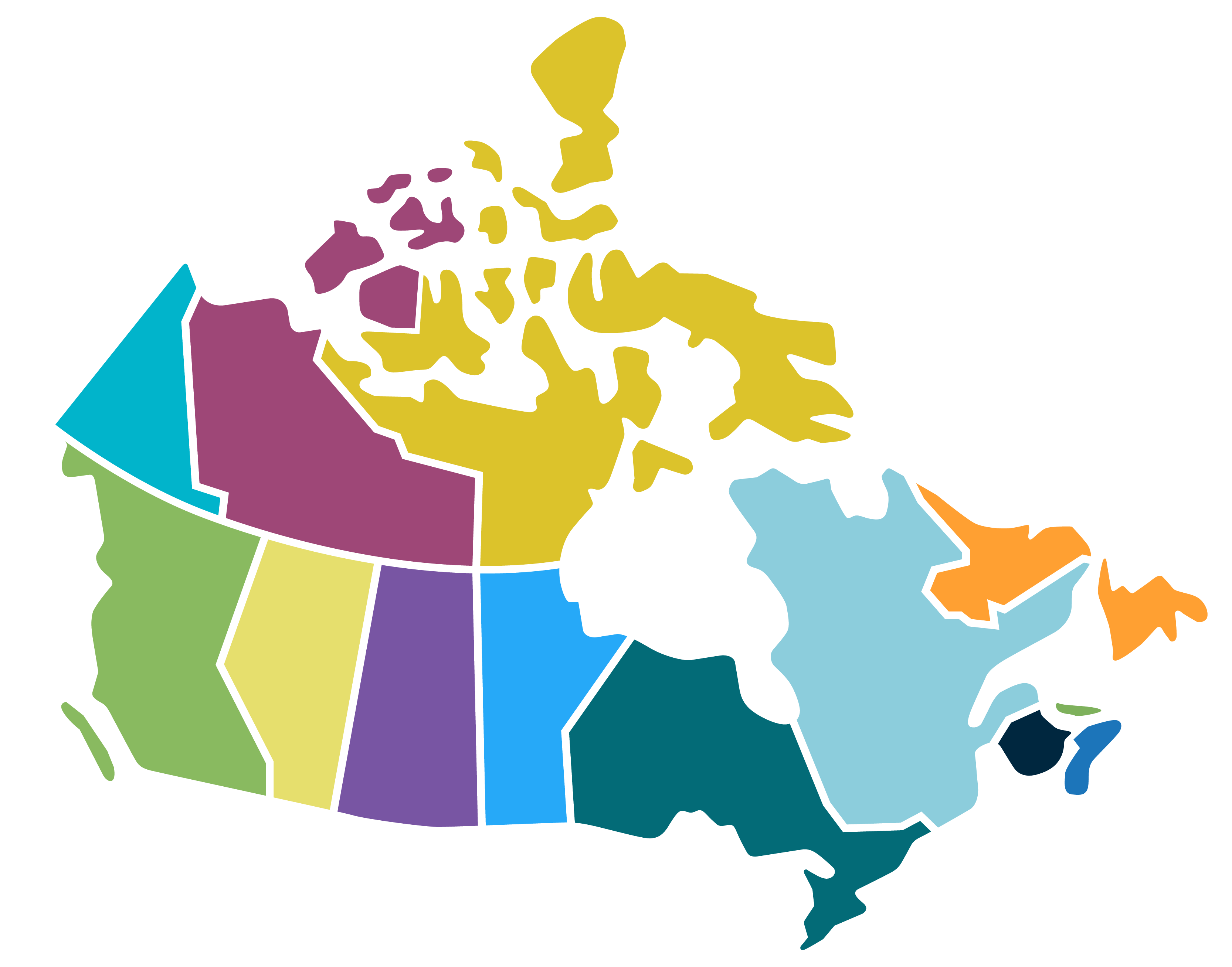

As Canada’s population continues to grow and change, segmentation helps us understand Canadians across multiple dimensions.

Learn the top intelligentSEGMENTS for each province and territory.

Get to know their core attributes, from demographics to consumer behaviours.

See how these insights pave the way for better targeting and results.

Some of Our intelligentSEGMENTS

A1 Big City Elites (0.86% HH)

These are the movers, shakers and famous of Canada. Average household incomes are comfortably in the six figures, but incomes in the seven figures are common. Patrons of the arts, front row season ticket holders to major sports teams, and extensive travel are part of their lifestyles.

C4 Deal Seekers (1.03% HH)

Everyone loves a deal, and these deal seekers have the highest concentration of Joe Fresh and Marshall's shoppers. A mixed group of mainly European and Asian backgrounds, this group generally lives in the outskirts and suburbs of Toronto.

E3 - Urban Diverse Rented Homes (0.64% HH)

This group lives in and around urban centres like Toronto and Montreal in rented duplexes, row houses and semi-detached houses, where they raise their children (often alone). For this group, live events are better, so you'll find them at baseball, film festivals, live theatre, soccer and basketball venues.

G2 Studio Apartment Living (3.13% HH)

With a population of 40% visible minorities, this group is a diverse crowd. Despite having little left over at the end of the month, having the latest tech device, keeping up on fashion, and the occasional dinner out are part of their lifestyle.

H3 Français sophistiqué (0.29% HH)

La belle vie! These Francophone Canadians enjoy life across Quebec's cities, both large and small (85%). They enjoy fine dining restaurants, and both imported and craft wines and beers. Of all groups, they spend the most on tobacco and alcohol.

L3 Small City Fans (1.23% HH)

It's hockey night in Canada: these fans from primarily smaller Canadian cities like Calgary, Edmonton and Ottawa work mid-level white collar management and administrative jobs. In true "working for the weekend" style, this group likes to get away, and they book pre-packaged vacations at all-inclusive resorts in the sun.

O5 Familles de petites villes de banlieues au Québec (1.78% HH)

The people in this group are educated with college degrees and trades certifications, which provide jobs generating above average incomes. These large, common-law couple families live in mid- to large-sized suburban homes, and represent a large segment of Quebec's population.

T4 Rural Routes and Pick up Trucks (3.31% HH)

This group hails mostly from the East Coast (54%), Ontario (20.2%), and Manitoba & Saskatchewan (18.8%). They work blue collar jobs in manufacturing and farming. They mainly come from Northern European backgrounds, or identify as Aboriginal (16.6%) or North American Indian (14%). When not working, they fish and snowmobile in the winter, and they prefer to stay home with friends and family over going out.

Understand Canadians with Insights Reports

Automated audience insights to refine targeting and guide your strategy.

Generate robust profile reports in intelligentVIEW across key attributes.

Identify audiences with the NEW segment opportunity chart.

Measure market opportunity across Canada with comparison reports.

Use heat maps to target audiences by market and neighbourhood.

Insights from CiG

Canadian Targeting Solutions for Tight Media Budgets

Learn how to overcome budget constraints and meet high expectations...

Read MoreWhy You Should Use Direct Mail to Enhance Digital Campaigns

Direct mail drives results; here’s why it is time to...

Read MoreSuccess Story: 6% Increase in Sales for Papa John’s

Pizza is a favourite among Canadians and Papa John's knows...

Read MoreReady to take a closer look?

Spend some time reviewing a sample report on your own, or request a demo to see what intelligentVIEW can do to power your marketing programs.